International franchises need to graduate from employing a software provider to partnering with a tech company that has customer-centric approaches, tech knowledge, and international fitness industry experience.

International franchises need to graduate from employing a software provider to partnering with a tech company that has customer-centric approaches, tech knowledge, and international fitness industry experience.

Smoothly entering growing new markets, altering business models to meet customer demands and staying ahead of global trends requires flexibility and understanding for enterprise fitness clubs to expand. And this can only be gained from working closely with an advanced software provider with broad international experience.

Currently, the industry is enjoying a sustained period of growth. With higher consumer awareness of health and wellness, the commodification of fitness has skyrocketed in popularity.

This in turn has triggered huge fitness market growth, from which clubs have lucratively benefitted from. This has given enterprise gyms more opportunities and better means to avoid stagnation through entering the global market.

However, as a byproduct of international expansion, business complexity has increased and the need to digitally transform has become more urgent for clubs to first stabilize the velocity of their growth; and second, centralize their operations.

According to the European Health and Fitness Market Report, fitness in Europe has held an annual growth rate of 5.5 percent. On average, 1 in 10 Europeans owned a fitness membership in 2018.

Similar growth can be seen in the rest of the global fitness market, too. In mature or disruptive markets such as most Western European countries and North America, the increase in fitness membership was fueled by the availability of budget fitness operators which increased fitness affordability for citizens.

For example, membership and the total number of clubs all increased in the U.S. from 2017 to 2018, with revenue growing by 2.3 billion dollars within a year.

In immature markets such as Eastern European countries and Southeast Asia, the growth has been driven by an increase in disposable income, opening the fitness market to a bigger demographic. Romania has been one of the fastest-growing fitness markets in Europe, driven by both penetration and price increases.

Over in the east in one of the most densely populated countries, China’s fitness market penetration rates are also increasing at a surprising pace. After 15 years of evolution, the fitness club market in China is characteristically diversified with large chains, small studios, and new business models to address the market’s various needs.

The fitness club market in India is also highly fragmented, with the biggest 10 chains only summing up to 15-20% of the overall market in terms of the number of clubs. India has one of the lowest penetration rates at 0.15% and is still considered an immature market. Right now, there are many campaigns initiated in India to raise consumer wellness awareness in order to increase interest from international health clubs to invest there.

Looking forward, the global health and fitness market is projected to continue its upward trajectory, with experts prophesying that the industry will reach more than 64 million members and EUR 27.6 billion in value by 2023.

Most of the trends that grew in the past are expected to continue, such as consumer wellness awareness and market economic growth which allows more people to afford memberships and, as a consequence, drives prices down.

In response to this, by using a prevalent expansion strategy that has emerged amongst key players in the industry, enterprise gyms are also, in part, fueling global fitness market growth.

Within mature and disruptive markets, franchise gyms are acquiring popular middle players and then undergoing brand switches which allows them to increase their market share very quickly.

With its recent acquisition of Pure Barre, fitness curator XponentialFitness, LLC, has gained another 517 studios in the U.S. and Canada. The California-based brand, Xponential Fitness, now holds seven boutique fitness brands, this includes, Club Pilates, CycleBar, Row House, Yoga Six, StretchLab, and AKT (developed by celebrity trainer Anna Kaiser).

One important consequence of gym acquisitions within developed markets is that bloated brands are then have more resources at their disposal.This emboldens enterprises to take bigger risks by entering other emerging markets that have less competition but growing penetration rates.

This is demonstrated by the case of Dallas-based Gold’s Gym. In 2018, the brand opened six domestic clubs. And on the global side, Gold’s Gym added eight new locations to immature market India; increasing its presence in growing market Japan from 73 to 76 facilities; as well as developing two new gyms in the Dominican Republic.

In more of a long term strategy, Fitness 24Seven has also begun in the last year to focus their attention on Latin America, and more specifically, the immature market of Columbia. Having opened seven new sites in the country, the company is planning on organically developing their position in the Columbian fitness market.

It’s an exciting time for international gym brands. Global growth opportunities are widely available, but entering new fitness markets isn’t always a smooth process for enterprise clubs.

Due to the diversity of market behavior, tax rules, and data laws, brands can have a difficult time adjusting to setting up a fitness club in a new country, no matter how mature that market is.

Payment integrations, for example, are just one sore spot for enterprise brands when entering a new market.

Due to the business complexity of an enterprise, corporate headquarters must be able to maintain direct access to facility accounts; however, not all payment providers can deliver this for corporations. If headquarters do not have continuity in the flow of facility data, it can develop into an operational nightmare and blindside managers. Facility payments then demand more and more top-level executive attention to adequately manage.

With that said, sometimes enterprises have no choice in the matter of selecting their payment solution. When entering a new territory, untested local providers may be the only legitimate option left for a gym. This is especially evident in certain locations where banks are only permitted to work with a few select payment providers.

For a brand, this could mean embarking on painful processes to set up an integration for a payment provider who may not even be reliable nor customer-centric. In a way, this adds to the management strain of corporate leaders and master franchise supervisors to track fitness club finances. Stacking up these disparate payment service providers then creates friction for headquarters when attempting to assess, mine and report on the overall finances of an enterprise.

In so far, it is a necessary yet sub-optimal situation international gym brands have had to endure.

On a micro-scale, enterprises must also account for the market adjustments which will inevitably arise. There is no one-size-fits-all approach for new market gym openings, and fitness enterprises need to first understand their market right down to its local context before they open up a new club. Overlooking some crucial characteristics of a location may harm the business later or cause jarring issues for club operations.

Potential member behavior, problems, and desires will vary as a brand moves from market to market. To make a club customer-centric and ensure it stays in line with a brand’s overarching strategy, corporates need to get informed on what their clients may want in each country.

For example, in Romania, it has been found that people are willing to pay a premium for higher-quality facilities and workout equipment. The most important factor in choosing a gym for Romanians is the location.

Unlike in the UK, where the biggest reason for signing up to a gym is the low price of membership, Romania represents a smaller fitness demographic willing to spend their money, as long as the club is accessible. This means enterprises have the task of overhauling their membership offering to tailor it to certain markets.

As well as market behavior knowledge, brands can experience accounting and finance friction when they move to new countries.

In addition, managing different markets also calls for different language settings to be implemented on a system. This includes all online customer touchpoints, fiscal receipts, as well as back office functions to be translated every time a brand enters a new market. Depending on the alphabet used, this can really scramble the coding of a program, resulting in a huge development mess. Facilities then may be forced to engage in workarounds in order to stay operational, such as only hiring gym managers who can understand the system’s primary language.

Operating in such diverse markets calls for differing types of gym management software, which makes standardizing any operations near impossible for corporate.

As a result, enterprise fitness clubs are forced to over-engineer their processes, deforming them into costly burdens which reduce corporate control.

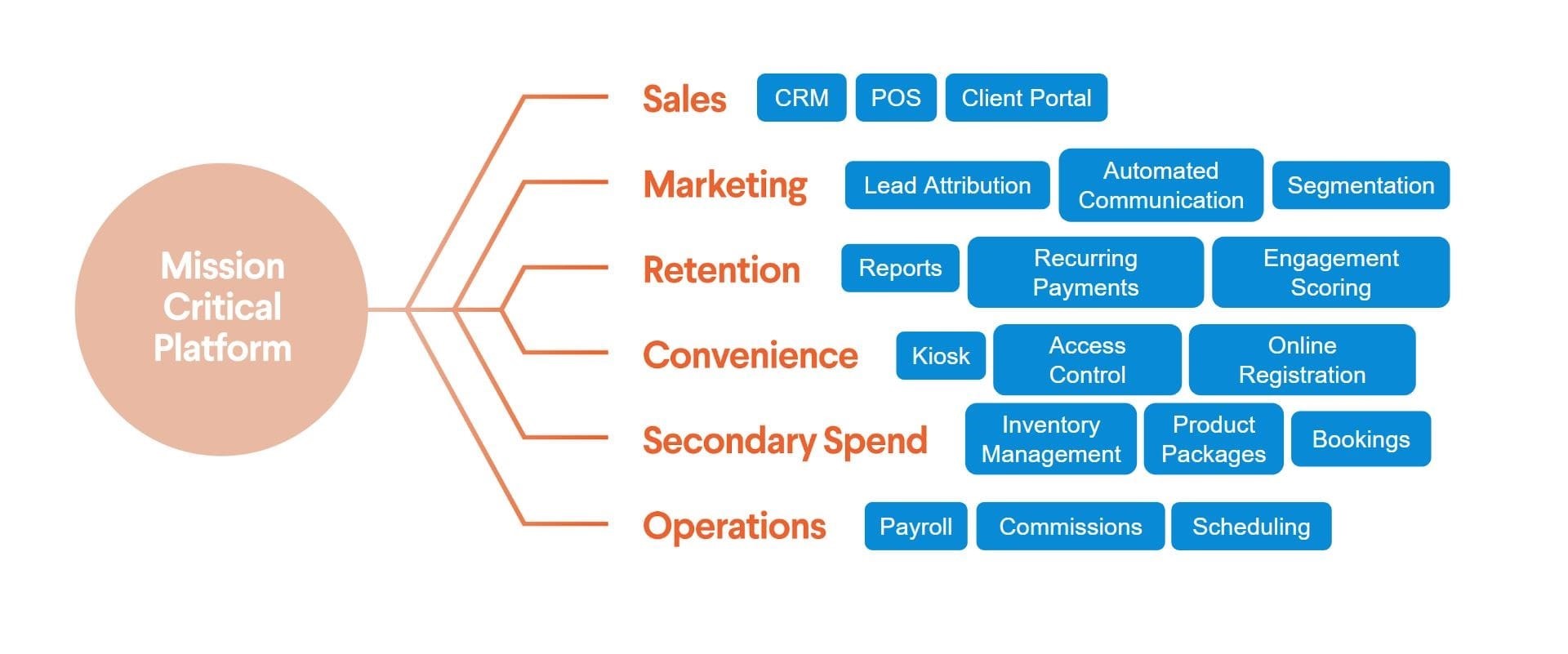

In response, international fitness brands need to look strategically at the management systems they install to manage their operations. Digital can empower brands to maintain and supervise their market areas with greater control and doing so can give a business a greater competitive advantage.

However, to fully leverage digital power, brands need to search for a company that can double as a global technology partner, rather than looking for individual gym management software which ticks market-specific boxes.

Flexibility and responsiveness to market needs is an essential element of managing international fitness clubs. When brands achieve global reach, they also achieve maximum complexity. This is where a technology partner, rather than a vendor becomes the most helpful in supporting corporate fitness brand growth.

Enterprises should look to work with software companies who have their own strategic portfolio of 3rd party providers.

Utilizing the connections of their own club management provider helps enterprises set up their new facility operations with more convenience .

SaaS companies with relevant industry insights will already have gathered other international providers who are trusted and tried, not just in terms of their product, but also in terms of their overarching strategy, mindset and values.

Through these connections, enterprises can access insider industry knowledge and reduce the time spent on entertaining other software prospects.

For example, selecting a reliable and compliant payment provider in a new market can be an arduous task. Established club management providers will already have recommendations to suggest the right provider for the club and market needs.

Some up-start payment providers are acquiring big multi-territorial footprints. Strategically minded Saas companies will know these providers and have already struck up partnerships in a bid to make their own client’s operational set-ups easier. This reduces the need to keep adding systems to an enterprises’ digital ecosystem when they expand into new territories.

In addition, partnering with a vendor who can deliver open API club management software which can allow enterprise headquarters to integrate a few multi-market payment providers into one central system. This enables enterprises to use less software, and still cover the same ground operationally, thus stripping back their software management needs and empowering corporate to enter countries quicker and smoother than their competitors.

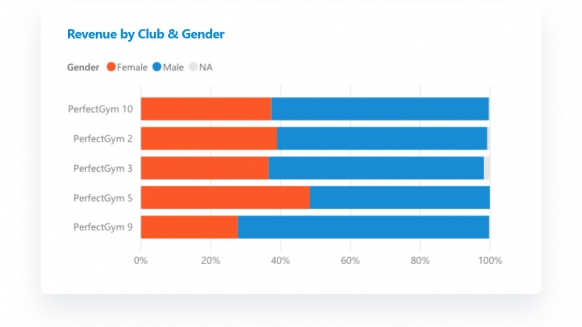

With one club management technology partner ready to work in tandem with different global payment providers, enterprise clubs can create and control a vast data warehouse all within one system. This gives them the chance to make comparisons and analyze their data on both a global and regional scale.

In short, an open API club management platform paired with a software provider’s expertise can optimize and flexibly manage the needs of each market’s club operations.

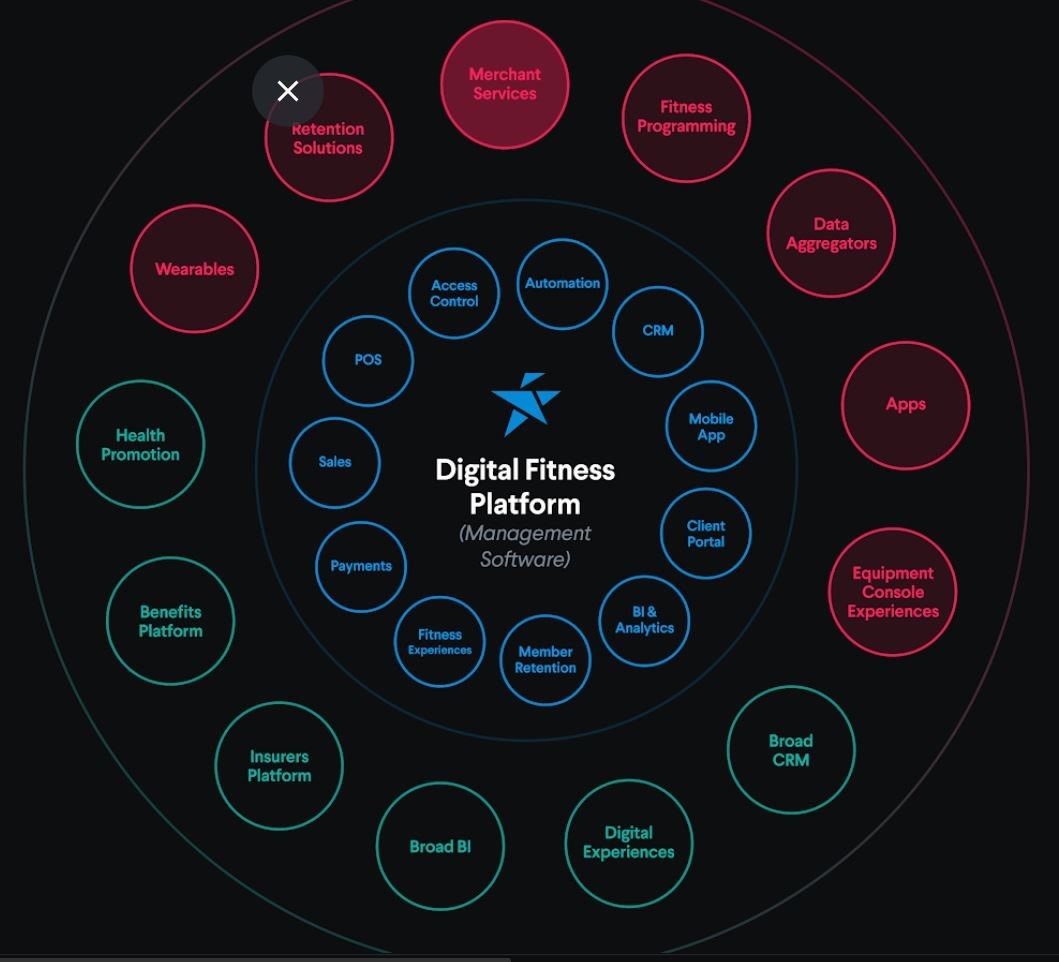

This also applies to enterprises looking to enhance their member experiences, too. Though late to emerge, fitness and technology are now rapidly fusing to form new data-driven fitness experiences for people.

Fitbit, 3D scanners, biometric trackers and smart home workout equipment are all elevating the wellness experience through placing personalized and more accurate performance metrics straight into the hands of the individual.

To survive the growing consumer attraction to digital fitness solutions, enterprise gyms need to work toward merging these popular experiences into their own offering.

Open API club management platforms coupled with fitness technology specialists can aid corporate in understanding their new market’s behavior and trends, as well as offer recommendations as to which digital experiences or apps can heighten an enterprise offer within a country.

In addition to this, corporations can further benefit from using a technology partner, rather than a software vendor when it comes to standardizing or customizing their management software to suit the needs of their individual markets.

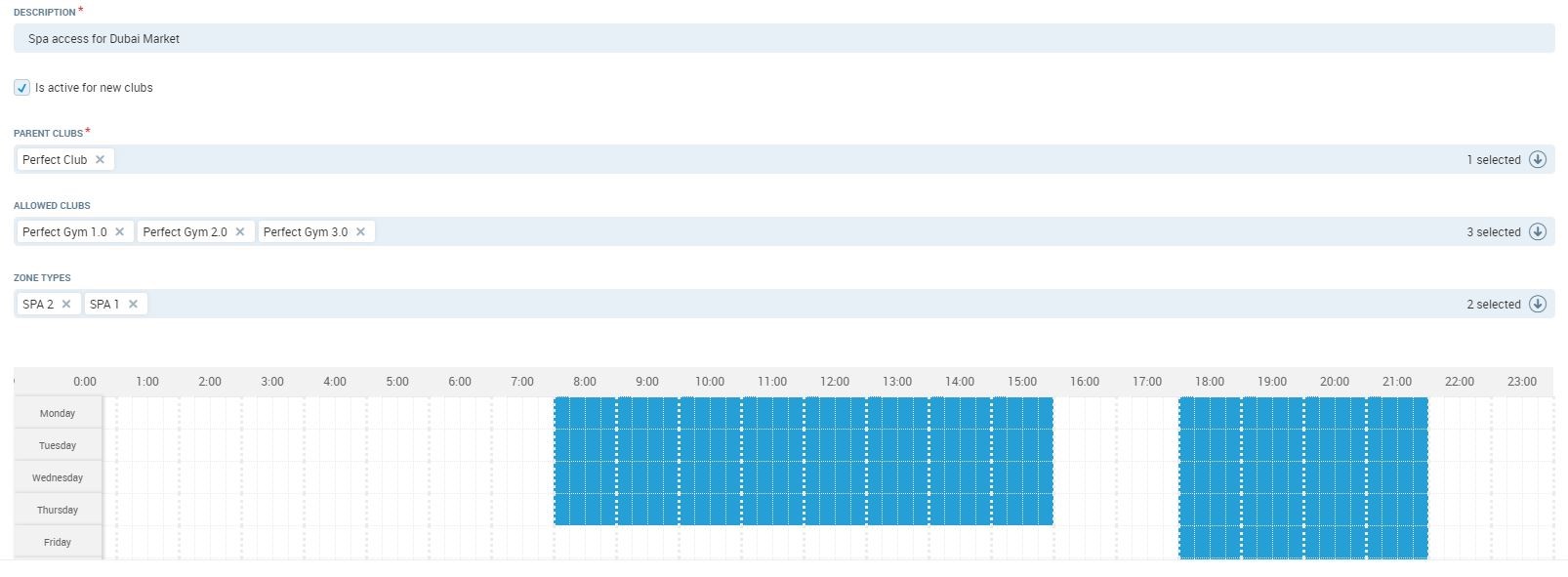

For example, headquarters can work with their software provider to grasp control of several top tier operations, such as changing access control hours for members market-by-market, accessing market-level data, changing a club’s membership payment plans to suit territory trends and more. In some countries, there are religious days on which, by law, establishments are unable to function. With this in mind, corporate can alter the access hours of that market from their club management platform.

Technology partners can afford enterprise gyms so much more guidance and insight as they enter new markets. Working in a partnership means customer-centric providers will relinquish control over their own platforms, in order to allow enterprise headquarters better control of their market operations.

Rather than wielding a software to simply execute the operations of a club, corporations can also gain a significant advantage by tapping into the experience established service providers have.

In partnering with a service provider, like PerfectGym, headquarters can gain more knowledge to inform their global business strategy, too.

With experts from a tech company, enterprises can add another layer of perception and analysis to problems, which can inspire uniquely tailored solutions for a company’s biggest pain points.

Through using time-tested market knowledge when working with other global brands, enterprises can learn from the mistakes their software provider made before without any of the costly consequences.

PerfectGym has already been deployed in 54 markets around the world on six continents. Our past market experience is beneficial for our enterprise partners, as it allows them to prepare for country-specific problems. Leveraging the knowledge of a leading technology fitness company can reduce risk and significantly propel an enterprise forward in the right direction.

Having operated in the fitness market for more than a decade, PerfectGym is also a hive of digital wellness knowledge. Established software providers will not only focus on their own product but also keep a keen eye out for industry changes which might result in the need for further product or service development.

Watching market movements is how software providers are able to tailor their solution so it fixes the current problems of enterprise fitness brands.

With an open API club management software, enterprises can roam free and choose their own experience partners, plugging them directly into the central system. Having an open API means corporate leaders can cancel out the process, time and cost of asking their software partners to build them an integration. This allows headquarters to cut out the middleman and wield greater control over who they’d like to integrate with.

Partners (clients) are afforded more of a say in terms of the network built in tandem with the software they use in order to provide a complete stack of tools used for operations, member experiences, and global corporate oversight.

As enterprise gyms gain velocity in their market expansion, they need reliable partners, not just reliable software to help flexibly execute their global strategy.

Evolving the relationship from vendor to tech partner can offer enterprises efficient mediators when operating in new markets, as well as add a new layer of insight when corporate revise their strategy.

The more complex an operation gets, the more eyes and brains are required to manage it. With the collision of digital in the fitness market both helping enterprises and also threatening them, fitness brands need more technologically minded partners from which they can leverage industry knowledge, agile-mindsets, and digital resources.

Discover how our innovative solutions can elevate your business. Request a demo today and see the difference firsthand. Let's grow, together!